Manufacturing Roars Past Recession Through 2016

posted on 12.11.14

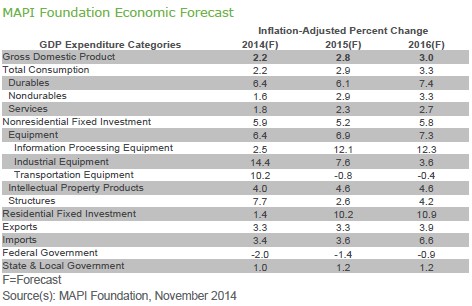

A comprehensive report from the The Manufacturers Alliance for Productivity and Innovation Foundation, predicts excellent growth ahead for US manufacturing. MAPI has released a quarterly economic forecast for the next two years, predicting that the inflation-adjusted GDP will increase 2.8% next year and 3.0% in 2016. This represents a decrease from their report in August which forecasted 3.0% and 3.3%, respectively. The November report also forecasts that over the next five years the GDP will experience an average growth of 2.8%. The manufacturing sector, however, will overtake the GDP with production increasing 3.5% in 2015 and 3.9% in 2016. Over the next five years, MAPI predicts an average growth of 3.26% for production in the manufacturing sector.

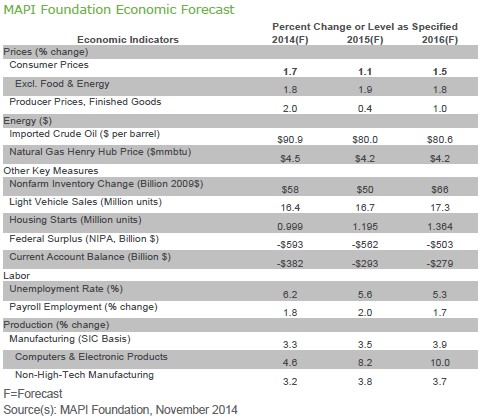

GDP growth of 2.8% and 3.0% expected for 2015 and 2016, respectively. Significant manufacturing job growth This growth will fuel an increase of 202,000 manufacturing jobs in 2015 with 16,000 more in 2016; estimates call for an average of 66,800 more manufacturing jobs over the next 5 years. Overall, MAPI calculates that unemployment will average 5.6% and 5.3% over the next two years, respectively. Daniel J. Meckstroth, Chief Economist at MAPI said, “We will have full employment in 18 months and manufacturing is already there…With the unemployment rate continuing to fall, the pain and suffering from the recession is dissipating. Why are businesses spending? Because consumers are spending. Also, the drop in energy prices is essentially a tax cut for us. Lower prices are a positive development.”

High-tech manufacturing forecasted for 8.2% and 10.0% growth for 2015 and 2016, respectively.

High-tech manufacturing leads the way Production in non-high-tech manufacturing is expected to increase 3.8% in 2015 and 3.7% in 2016. High-tech manufacturing production, which accounts for approximately 5% of all manufacturing, is anticipated to grow 8.2% in 2015 and 10.0% in 2016. The forecast for inflation-adjusted investment in equipment is for growth of 6.9% in 2015 and 7.3% in 2016. Capital equipment spending in high-tech sectors will also rise. Inflation-adjusted expenditures for information processing equipment are anticipated to increase by double digits in each of the next two years—12.1% in 2015 and 12.3% in 2016. The MAPI Foundation expects industrial equipment expenditures to advance 7.6% in 2015 and 3.6% in 2016. Conversely, the outlook for spending on transportation equipment is for decreases of 0.8% in 2015 and 0.4% in 2016. Spending on non-residential structures is anticipated to improve by 2.6% in 2015 and 4.2% in 2016. Residential fixed investment is forecast to increase 10.2% in 2015 and 10.9% in 2016. Meckstroth anticipates 1.2 million housing starts in 2015 and 1.4 million in 2016. Inflation-adjusted exports are anticipated to increase 3.3% in 2015 and 3.9% in 2016. Imports are expected to grow 3.6% in 2015 and 6.6% in 2016. The MAPI Foundation forecasts overall unemployment to average 5.6% in 2015 and 5.3% in 2016. The refiners’ acquisition cost per barrel of imported crude oil is expected to average $80.00 in 2015 and $80.60 in 2016.

Article provided in partnership with Manufacturers Alliance for Productivity and Innovation. Written by Shawn Wasserman, Engineering.com.